How to Hire Employees in China Without WFOE

- ExpertinChina

- Sep 26, 2025

- 5 min read

Updated: Nov 11, 2025

Intro

Foreign investors have long treated China’s labor market like a high-security vault. You need a local key (a Wholly Foreign-Owned Entity) just to peek inside. That belief is outdated. Under 2025 rules, you can onboard engineers, sales reps, or supply-chain gurus within a month—without incorporating, flying to Beijing, or smuggling payments through friends in Hong Kong. The shortcut is a government-licensed Talent Dispatch agency that becomes the legal employer while you keep strategic control.

This Q&A pocket guide answers the 20 questions investors ask most, from visa speed-runs and social-insurance math to IP ownership and painless exit clauses. Read it on the flight, share it with your CFO, and land Monday with a compliant Chinese payroll that scales until you’re ready to open your own WFOE.

Understanding the Hiring Process in China

Q: I want to hire a software engineer in Shenzhen, but my Delaware LLC has no Chinese entity. Is that even legal?

A: Yes—if you use the right “bridge.” China forbids direct employment by foreign companies without a registered entity. However, you can engage the worker through a Licensed Talent Dispatch (LTD) agency or a Professional Employer Organization (PEO). The LTD becomes the legal employer on paper while you retain day-to-day control.

Q: What exactly is an LTD agency?

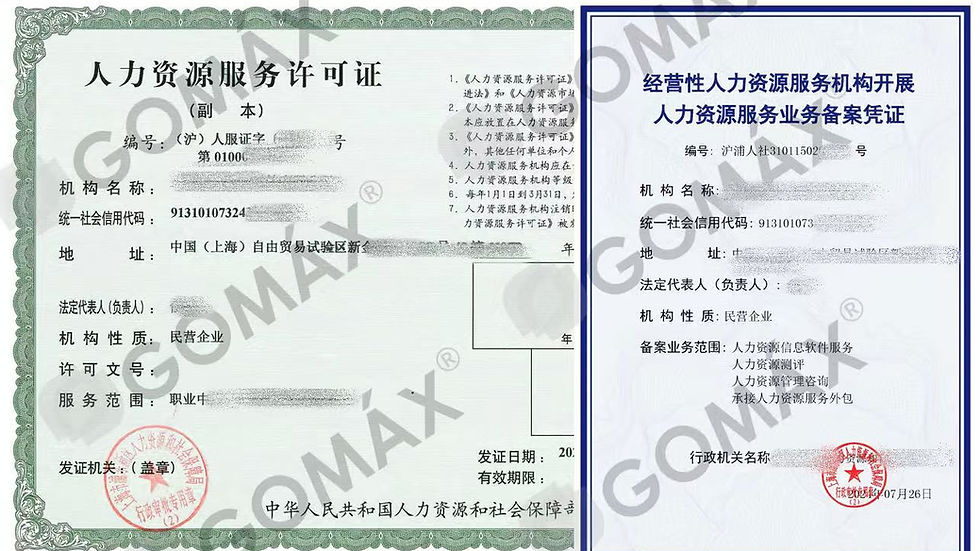

A: Think of it as a government-approved temp agency on steroids. It holds a Human Resources Service License (人力资源服务许可证) and a Dispatch License (劳务派遣经营许可证). It signs the labor contract, sponsors the work visa, and runs payroll. You sign a service agreement with the LTD, not with the employee.

Q: How is that different from a PEO?

A: In China, the two terms are often used interchangeably. However, a PEO usually bundles extra services—recruitment, visa desk, device provisioning, even co-working seats. LTDs stick to core compliance: contract, visa, payroll, and statutory benefits.

Q: So I never co-sign the labor contract?

A: Correct. The LTD is the only signatory. Your service agreement with the LTD should, however, grant you “right-to-direct” clauses: job description, KPIs, termination trigger, IP assignment, non-compete, and confidentiality.

Q: Who pays the salary and social insurance?

A: The LTD runs payroll and withholds Individual Income Tax (IIT). It also enrolls the employee in the “five insurances and one fund” (五险一金): pension, medical, unemployment, work-injury, maternity, plus the housing fund. You reimburse the LTD grossed-up for employer and employee portions plus a service fee (typically 8-15% of gross salary).

Q: Can the salary be paid in USD offshore?

A: Only the net-after-tax portion can be remitted offshore in foreign exchange. The IIT and the social-insurance piece must stay in CNY inside China. The LTD will ask for your offshore wire first, then convert and pay locally.

Q: What visa does the employee get?

A: The LTD sponsors a Work Permit (外国人工作许可证) and a Z-visa/residence permit. If the candidate is mainland Chinese, no visa is needed; the LTD simply registers the labor contract with the local HR bureau.

Q: How fast can the visa be issued?

A: For candidates already in China on a valid residence permit, it takes about 3–4 weeks. For overseas hires, add 1–2 weeks for Z-visa stamping at the Chinese consulate. COVID-era backlogs are gone, but document authentication (degree, non-criminal record) still takes 2–3 weeks.

Q: What documents must I prepare?

A: You only provide a signed service agreement and the job description. The candidate supplies authenticated degree, two-year post-grad work proof, non-criminal record, and medical check. The LTD handles translation, online upload, and bureau visits.

Q: Can I hire part-time or freelance?

A: Technically yes, but China has no “freelancer” visa category. The safe route is still a full labor contract with the LTD, requiring a minimum of 20 hours per week. Otherwise, the work permit may be rejected.

Q: What are the statutory minimums I must respect?

A:

1-month written contract within 1 day of onboarding.

8-hour day, 40-hour week, 1.5×/2×/3× overtime pay.

5–15 days paid annual leave (scales with tenure).

98 days statutory maternity leave (128+ in many cities).

30-day notice (or 1-month salary in lieu) for termination without cause.

Your LTD ensures compliance; you just reimburse.

Q: Who owns the IP the engineer creates?

A: Chinese Labor Law defaults IP to the employer—the LTD. Your service agreement must therefore back-to-back assign all rights to you. Include explicit clauses on patents, copyrights, trade secrets, and moral rights waiver.

Q: Can I terminate the person at will?

A: No. China is not an at-will jurisdiction. You need statutory cause (serious misconduct, incompetence with training, material change of objective circumstances). The LTD will conduct the termination procedure; you pick the bill: notice pay, severance (½ month per year of service), and any negotiated extra.

Q: What does the whole thing cost, ballpark for hiring employees in China?

A: Take a gross monthly salary of CNY 30,000 (≈ USD 4,200).

Employer social insurance & housing fund: ~34% ≈ CNY 10,200

IIT (after 60 k CNY annual deduction): ~ CNY 3,090

LTD service fee 12%: CNY 3,600

Total invoice to you: ~ CNY 46,890 (USD 6,550). Budget 55–60% on top of gross salary to be safe.

Q: Any hidden extras?

A: Yes—annual work-permit renewal (CNY 800–1,500), compulsory supplementary medical insurance in some cities, and a mandatory “high-temp subsidy” if the employee works outdoors in summer (CNY 200/month for 4 months). Your LTD fee quote should itemize these.

Q: How do I pick a reliable LTD/PEO?

A:

Verify dual licenses on the Ministry of Human & Social Security website.

Ask for client reference letters in your industry.

Insist on a dedicated English-speaking account manager; 90% of escalations happen because of mis-translation of labor-law nuances.

Make sure their EO insurance covers IP infringement and labor disputes.

Q: Can I switch agencies later?

A: Yes, but you must terminate the old labor contract and re-sign with the new LTD. The work permit number changes, so schedule the switch when the residence permit is up for renewal to avoid extra trips to the Exit-Entry Bureau.

Q: What if I plan to open a WFOE next year?

A: Insert a “migration clause” in the initial service agreement: when your Wholly Foreign-Owned Enterprise (WFOE) is ready, the LTD will terminate the labor contract and the employee transfers to the WFOE without severance. The work permit can be migrated in-city within 5 working days.

Q: Any 2025 regulatory updates I should watch?

A:

Starting 1 July 2025, IIT brackets widen by 8%; budget slightly lower net-to-company cost.

Pilot e-work-permit in Shanghai and Shenzhen—fully digital, no sticker in passport.

New Data Security Review Measures: if your hire touches >100k personal records, the LTD must file a data-cross-border assessment; factor 2–3 weeks into onboarding timeline.

Q: Bottom line—what’s my first to-do this week?

A:

Short-list 3 licensed LTDs in the target city.

Send them the job description and desired gross salary.

Ask for an all-in quotation (salary, statutory burden, IIT, service fee, FX spread).

Pick the agency, sign the service agreement, and open the offshore remittance account.

Send the candidate the document-authentication checklist.

You can have a legally compliant, fully paid Chinese employee on the ground in as little as 4 weeks—no entity, no red tape, no sleepless nights.

How ExpertinChina Can Help

As a licensed HR services provider, ExpertinChina, powered by Gomax International, provides comprehensive EOR (Employer of Record) and HR solutions for foreign companies entering China:

Full EOR Services: Legally employ staff without establishing a local entity; ensure full compliance with social security, housing fund, and payroll regulations.

Payroll & HR Management: Handle wage reporting, tax withholding, and contribution calculations; prevent fines and audit risks.

Compliance Advisory: Support contribution base adjustments, cross-province employment, and probation/intern compliance.

Flexible Workforce Solutions: Manage contract workers, temporary staff, and international assignees with transparent legal coverage.

With ExpertinChina, your team can focus on business growth while staying fully compliant with China’s evolving employment regulations.

Check our EOR solution and start your free consulting today!

Comments